The Pros and Cons of Low interest Rates

The Federal Reserve plans to cut interest rates starting in September 2024. These changes are implemented through adjustments to the “Fed Funds Target Range,”1 which financial institutions use to set their own interest rates.2 The upcoming rate cuts will significantly impact loan accessibility and economic inflation.

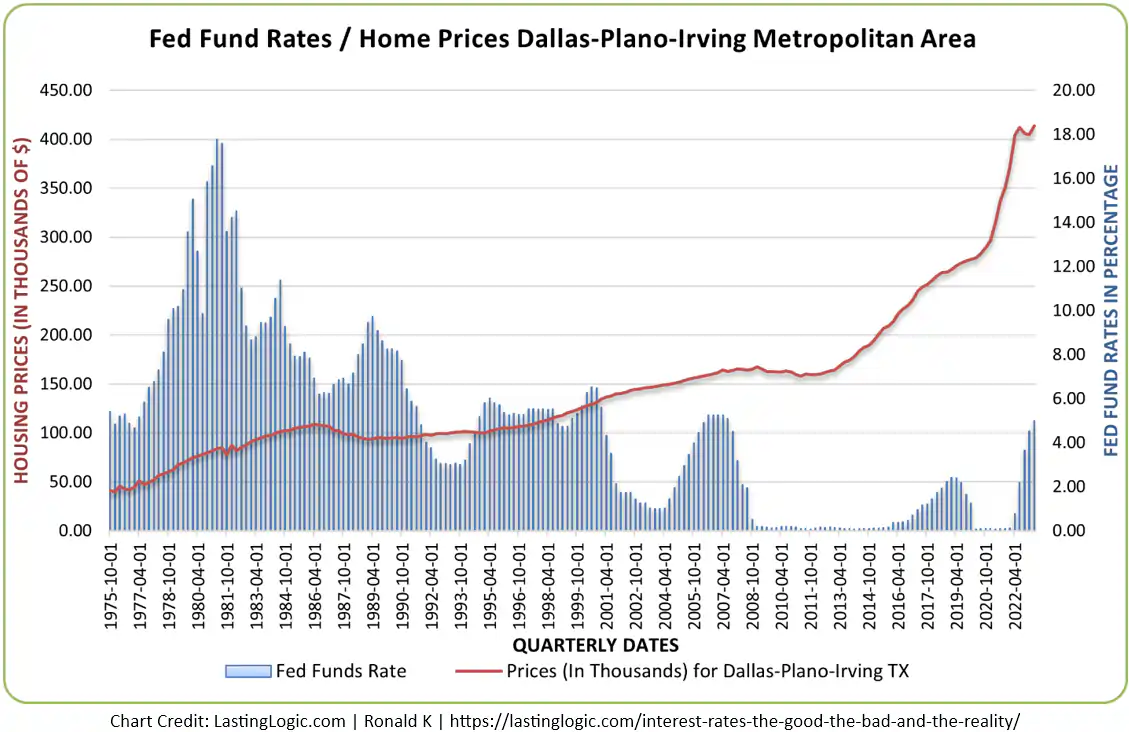

Advocates of low interest rates often exaggerate concerns about rates rising between 5.25% and 5.5% over the last sixteen years. However, they seldom address the inflation caused by excessive cash chasing too few goods or the housing bubble fueled by low rates. The inflationary costs of these low rates linger, even though current moderate rates may not.

A Fiscal Health Check

What are the results of low interest rates over the last 15 years and 7 months since the Fed first decreased Fed Fund Rates to the 0%-0.25% range in December of 2008?

- The credit card debt in the United States is a record high $1.142 trillion.3 During the last prolonged recession, it peaked at $866 billion in the last quarter of 2008.4

- The mortgage loan debt during the first quarter in 2024 was a record high $20.28 trillion.5 That number was $14.78 trillion at the height of the subprime mortgage crisis in the second quarter of 2008.6

- In June of 2024, the seasonally adjusted annual rate of savings in the USA was 3.4%. The only period since 1959 that rivals that dwindling number is between 2005 and 2009, during the economic meltdown.7

- “According to the latest industry data, 23.5 million Americans owe a collective $245 billion in personal loans, more than double the $117 billion owed in 2017.”8 That balance was $71.6 billion in 2008.9

- As of the second quarter of 2024, the total student loan debt in the U.S. stands at approximately $1.74 trillion. In the second quarter of 2008, at the beginning of the economic collapse, student loan debt was $ 626.6 billion.10

- Fed Funds Rate Period Averages:11

- July 1954 through December 1959: 2.36%.

- 1960s: 4.18%.

- 1970s: 7.10%

- 1980s: 9.97%

- 1990s: 5.15%

- 2000 through November 2008: (prior to the multi-year recession) 3.29%

- December 2008 to July 2024: 1.06% (the 15-year 7-month period following the Fed dropping the rates to 0-0.25%)

A Significant Error

The Bureau of Labor Statistics (BLS) adjusted the annual March 2024 total nonfarm employment “preliminary benchmark revision” down by 818,000 jobs, from approximately 2.9 million to around 2.1 million.12 The BLS states this as a 0.5% decrease, calculated based on the total nonfarm employment figures.13 In comparison, the annual benchmark revisions over the last 10 years have averaged plus or minus 0.1% of total nonfarm employment.14 The current downward revision of 0.5% is a troubling adjustment compared to the 0.1% average over the last 10 years.

The 818,000 fewer jobs than the estimated annual number of 2.9 million is a 28% error. The BLS total nonfarm employment number is one of the key economic indicators that the Federal Reserve considers when determining interest rates.

The Fed and the Lack of Accurate Information

The Federal Reserve uses jobs numbers and other data to determine monetary policy. The BLS numbers cited above are relevant to the Federal Reserve’s policy decision on interest rates. In 2021, Jerome Powell, the Federal Reserve Chair, and Janet Yellen, the current Secretary of the Treasury and former Federal Reserve Chair, referred to inflation as “transitory.”15 They later had to walk back those remarks.

We seemed to have overlooked how they could have mischaracterized inflation at the time. Was it a result of inaccurate data, and can they assure us of the validity of current data underpinning the decision to lower interest rates?

The Pros and Cons of Low Interest Rates

For now, the Feds decision is to lower interest rates. So, what are the advantages and disadvantages of low interest rates? Let’s look at the following list for a quick overview.

The top bullet-point is what low interest rates affect. The following bullet-points are the benefits and drawbacks of low interest rates on the affected topic. This is my opinion on the subject. Feel free to agree, disagree, or add to it. It is important to understand that interest rates are the price of money.

- Prime rate loans for mortgages, autos, etc.

- Pros: Low borrowing costs. The price of money is low which makes money easier to get. The monthly payment amounts decrease for interest, but not for the principal on a loan.

- Cons: The price of homes, autos, etc. increases because readily available money creates greater demand for those assets. The principal payment amount on a loan escalates disproportionately to the interest payment. Asset bubbles will occur if interest rates are low for prolonged periods.

- Property Taxes and Home Insurance Rates.

- Pros: Money may be available to borrow to pay property taxes and homeowner insurance.

- Cons: Property taxes and homeowners’ insurance are based on property values. As property values increase, property taxes and insurance costs increase.

- Property Maintenance Costs

- Pros: Home improvement loans have a lower borrowing cost.

- Cons: Material and labor costs to build and maintain homes and commercial property increase due to elevated demand for those products.

- Food and Other Consumer Goods

- Pros: Suppliers have access to low interest rate loans.

- Cons: Additional money supply creates more consumer demand which inflates product prices. At some point, the demand may far exceed the supply creating premium prices for fewer goods.

- Wages

- Pros: Wages may increase to meet rising consumer prices.

- Cons: Businesses pass increased wage costs along to the consumer in the form of higher prices. These higher prices are additional inflation costs. A cycle of wage increases causing additional inflation which demands higher wages may develop.

- Savings accounts and fixed income investment instruments such as CDs.

- Pros: None

- Cons: There is little to no Return on Investment for saving and investing in fixed income instruments; therefore, people spend more money creating more demand and higher prices which fuels inflation.

- Subprime Rate Loans.

- Pros: The interest rate for subprime loans is higher than prime rate loans, but still easy to get for most borrowers.

- Cons: Subprime lending was one of the causal factors the 2007-2010 housing mortgage crisis.16 Cheap subprime loans are still subprime loans.

- Corporate Money Supply

- Pros: Corporations, venture capital companies, and all businesses have access to readily available funds to expand, reinvest, and sustain their businesses. This can lead to higher levels of employment.

- Cons: Corporations can use excess capital to increase stock buybacks or for unnecessary business purposes. Artificially inflated stock prices and activities such as corporate bulk purchasing of homes drive up asset prices.

- Stock Market

- Pros: Corporate expansion and reinvestment can lead to increased profits which justify higher stock prices.

- Cons: Individuals do not receive a return on fixed income instruments; therefore, low-risk fixed-income investment instruments are not a part of a diversified financial portfolio. The portfolio consists of higher risk equities and funds which may provide a meaningful return or deep losses.

Juicing the Economy

In response to an inflated housing market, the collapse of financial institutions, and a subsequent recession, the Fed set the target Fed Funds rate between 0% and 0.25% from December of 2008 to November of 2015. “By mid-2013, the percent of homes entering foreclosure had declined to pre-recession levels and the long-awaited recovery in housing activity was solidly underway.”17

The Federal Reserve did not raise interest rates by mid-2013 after the recession abated.18 They kept juicing the economy with low interest rates for an additional 2½ years. That is analogous to continuing to apply defibrillator paddles to a patient whose heart has returned to a normal rhythm.

For 2 more years, from April of 2020 to March of 2022, the Fed once again set the target Fed Fund rate between 0% and 0.25%. The current broader inflationary problem began in 2021. In the 13 years between 2008 and 2021, nine years had excessively low interest rates, 0-.25% Fed Funds Rates. Four years had Fed Funds Rates which were never over 2.5%. Today, we have problematic inflation and a housing crisis.

Conclusion

In the past, businesses and the public managed money differently. The price of money, interest rates, made money valuable; therefore, we treated it as a valued asset. We saved it, and we often invested it in low-risk financial instruments. When we spent it, we tried to make sure we got our “money’s worth.”

Now, the emphasis is not on how much something costs, but rather on how much are my monthly payments. Perhaps the inflation from prolonged low interest rates brought us to the point that we can no longer afford what things cost. We were once a nation of savers. Now, we are a nation of debtors. What will we do when principal costs become so high that we can no longer afford the monthly payments, even with a low interest rate?

- Board of Governors of the Federal Reserve System (US), Federal Funds Target Range – Upper Limit [DFEDTARU], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFEDTARU August 31, 2024. ↩︎

- James Chen, “Federal Funds Rate: What It Is, How It’s Determined, and Why It’s Important,” Investopedia, updated June 18, 2024, reviewed by Erika Rasure, fact-checked by Yarilet Perez, https://www.investopedia.com/terms/f/federalfundsrate.asp. ↩︎

- Matt Schulz, “2024 Credit Card Debt Statistics,” edited by Dan Shepard, LendingTree, updated August 23, 2024, https://www.lendingtree.com/credit-cards/study/credit-card-debt-statistics/. ↩︎

- Schulz, “2024 Credit Card Debt Statistics.” ↩︎

- Mortgage Debt Outstanding, Millions of Dollars; End of Period, FRED Economic Data, Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/release/tables?eid=1192326&rid=52. ↩︎

- Mortgage Debt Outstanding. ↩︎

- U.S. Bureau of Economic Analysis, Personal Saving Rate [PSAVERT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PSAVERT , August 27, 2024. ↩︎

- Matt Schulz, “Personal Loan Statistics: 2024,” edited by Dan Shepard, LendingTree, June 20, 2024, https://www.lendingtree.com/personal/personal-loans-statistics/. ↩︎

- Schulz, “Personal Loan Statistics: 2024.” ↩︎

- Consumer Credit Outstanding (Levels), Board of Governors of the Federal Reserve System, last updated August 7, 2024, https://www.federalreserve.gov/releases/g19/HIST/cc_hist_memo_levels.html. ↩︎

- Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FEDFUNDS , August 28, 2024. ↩︎

- Current Employment Statistics – CES (National), 2024 Preliminary Benchmark Revision, Bureau of Labor Statistics, last modified August 21, 2024, https://www.bls.gov/ces/notices/2024/2024-preliminary-benchmark-revision.htm. ↩︎

- Bureau of Labor Statistics, Current Employment Statistics – CES (National), 2024 Preliminary Benchmark Revision, August 21, 2024, https://www.bls.gov/ces/notices/2024/2024-preliminary-benchmark-revision.htm. ↩︎

- Bureau of Labor Statistics, Current Employment Statistics – CES (National), 2024 Preliminary Benchmark Revision, August 21, 2024, https://www.bls.gov/ces/notices/2024/2024-preliminary-benchmark-revision.htm. ↩︎

- Jeff Cox, Yellen says the administration is fighting inflation, admits she was wrong that it was ‘transitory’, CNBC, June 1, 2022, https://www.cnbc.com/2022/06/01/yellen-says-the-administration-is-fighting-inflation-admits-she-was-wrong-that-it-was-transitory.html. ↩︎

- John V. Duca, “Subprime Mortgage Crisis 2007–2010,” Federal Reserve History, Federal Reserve Bank of Dallas, November 22, 2013, https://www.federalreservehistory.org/essays/subprime-mortgage-crisis. ↩︎

- Duca, “Subprime Mortgage Crisis 2007–2010.” ↩︎

- Duca, “Subprime Mortgage Crisis 2007–2010.” ↩︎