The Federal Reserve and the Price of Political Policy

As I write this post, the S&P is down 180 points, and the Dow is down 1,050 points. The financial pain is palpable. Financial gurus and billionaires have vaulted onto the media circus ride claiming the Federal Reserve’s most recent Fed Fund rate decision is the problem. Many say the Federal Reserve’s August 2024 decision to hold the Fed Fund rate at 5.33% is leading the USA into a recession.

Cheap money advocates have addressed the Federal Reserve’s decision to normalize interest rates with the wrath of addicted junkies who can’t get their fix. Whether it’s a shortened attention span, greed, or willful ignorance, cheap money advocates are unwilling to admit the problem is not the Fed normalizing interest rates. It is a deep-rooted problem that does not have a quick fix.

The Fed Fund Rate: A Key Component of a Healthy Economy

The Federal Reserve sets the Federal Funds Rate, referred to as the “Fed Fund rate.” Financial institutions base consumer interest rates on the Fed Fund rate. Economists and the financial elite considered a Fed Fund rate between 5.25% and 5.50% normal for a healthy economy prior to 2008. We have not had a healthy economy for years. It appeared healthy because of a cosmetic money makeover beginning in late 2008. As with most makeovers, it could not endure the test of time, and the bill came due for that cosmetic transformation.

The Hype

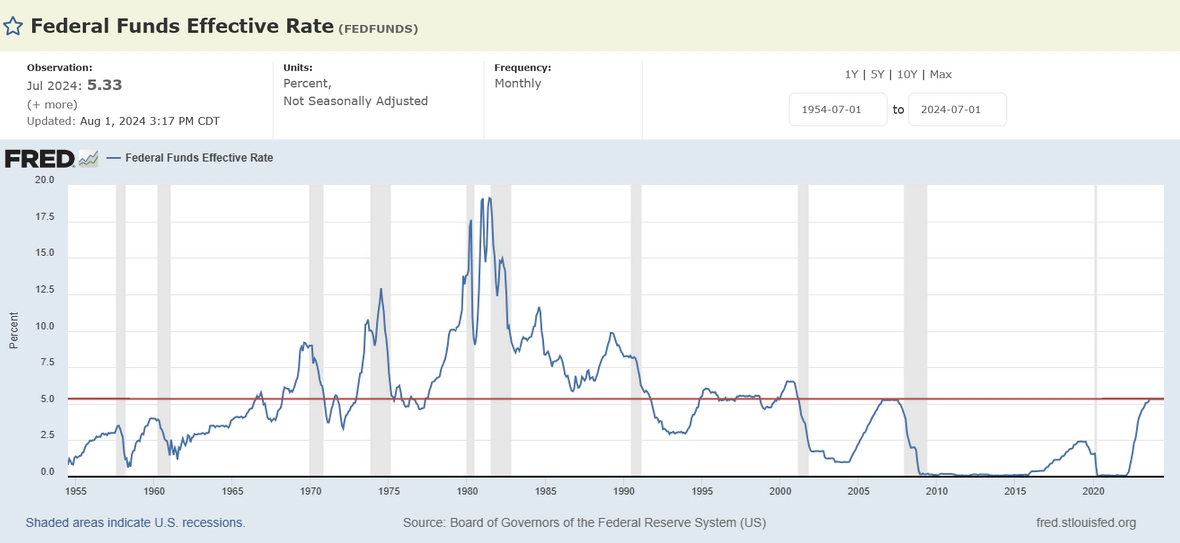

Some economists have used hyperbolic rhetoric like “sky high”1 to characterize today’s Fed Fund rate which hovers between 5.25% and 5.50%. Please allow me to show you “sky high” since there is confusion on the subject. This is a Board of Governors of the Federal Reserve System (US) chart of the Fed Fund rates since July of 1954 to July of 2024.2 The red line is on the current Federal Fund Effective Rate (EFFR) of 5.33%. The Fed Fund rate affects consumer interest rates.

The Reality

The current Fed Fund rate of 5.33% is not “sky high.” The current rates are in line with normal rates prior to 2009. Look at the graph for a reality check. For those who have read my previous posts, this is nothing new. Historical information should be edifying and a guide, not an inconvenient obstacle to realizing political or avaricious demands. Fed policy is meant to stabilize the economy, not supply free or cheap money to billionaires or the corporate elite.

Fed policy critics could have justified hyperbolic rhetoric during the 2008-2015 period when the Fed held rates at a virtual 0%. Let’s call that virtual 0% “dirt low” so we aren’t mixing metaphors. The chart is reality, not rhetoric. Let’s call the 17% to 19% rates of the late 1970s and early 1980s the “sky.” Does the current 5.33% rate still appear to be “sky high?”

The Cost of Borrowing and the Cost of Goods

One concept that some of us find challenging to accept is there is a monetary cost associated with borrowing money. Interest is that monetary cost. Simple. If you want money you haven’t earned, you pay for that money like any other product. It’s called capitalism. When the cost of money is cheap, it becomes plentiful like any other product that’s cheap. When money is cheap and plentiful, it loses value like any other product that is cheap and plentiful. Trading a cheap, plentiful product for something of value becomes a matter of quantity. You need more of the cheap, plentiful product to trade for the other product. Translation, inflation.

Lower interest rates mean more available money which causes the cost of goods to rise due to greater demand for the goods. Higher interest rates mean less available money which decreases demand. Less demand for a product causes the products’ valuations to stabilize or go down. This is the simple logic the Federal Reserve has used for decades.

The Federal Reserve should manage the interest rate tool properly. During the 2008-2015 period, the Fed utilized the Fed Fund rate in a way they never used it before. They lowered the rate to the virtual 0% level and later refused to hike the Fed Fund rate beyond the virtual 0%. It felt good at the time, but it was a problem with delayed consequences.

Between 2008 and 2015, the combination of multiple Quantitative Easing (QE)3 and a virtual 0% Fed Fund rate fuel injected cash into a sick economy. When the economy was recovering, the Fed didn’t start rate normalization. When the economy completely recovered, they still didn’t back off a policy meant only for a sick economy. That was the recipe for economic chaos. The kind of chaos that cannot lead to anything other than inflation.

A Prime Example: The Cost of Housing and the Cost of Money

We hear our economist friends complain that current interest rates are the barrier to buying new homes. Interest rates are not the problem. The inflated price of housing is the problem. Interest rates and the price on housing are two different issues, but interest rates have an inverse relationship with housing valuations and the price of all consumer goods. It is a supply and demand equation.

It’s worth repeating, interest rate is the cost of borrowing money. The cost of a home has gone up approximately 150% in ten years.4 The cost of borrowing money has gone up 5.33% in sixteen years. Cerebral economists and vociferous billionaires may want to dust off their calculator if that’s what is necessary to figure out the difference.

I have a previous post on this example.5 Please feel free to exam it, agree with it, disagree with it, or ponder it. The post relies on facts, figures, and logic, not conjecture, political whim, or greed. Our society has undergone a socialization process to believe short-term gain will never bring long-term pain. Multimillionaires, billionaires, and politicians foster that belief. They become authoritative sources of information that advocate for their own financial and political welfare, not for those outside of that circle. They don’t care if the price of a house has gone up 150% in ten years, but they do care if interest rates go up 5.33% in sixteen years.

Inflation

The price of most consumer goods has increased dramatically since 2008. Housing prices shot up. Consumer goods shot up. It wasn’t immediate. It was a slow economic poisoning that felt good. Who didn’t like eight years of cheap or free money? The stock market liked it. Corporations had access to copious amounts of cash to use for almost any purpose. No one was talking about the consequences of the slow-motion poisoning except for a few rational Federal Reserve Presidents who didn’t control Fed Fund rate policy.6

During the 2008-2015 period, the Federal Reserve took the economy into uncharted waters, a brave new economic world. The long-term consequence could only be economic inflation. In December of 2015, the Federal Reserve Chair, Janet L. Yellen, knew the problem existed and began rate hikes before inflation became an issue, but Covid-19 got in the way of rate hike policy. By 2021 the Federal government tried to tell us that inflation was “transient” and “temporary,” but you can’t talk your way out of inflation. By that time, cheap money was the accepted norm, and the poison of choice. Economists, corporations, financial institutions, and the public were addicted.

Conclusion

After the Covid-19 economic shutdown, the first time the Federal Reserve raised the Fed Funds rate above 1% was in June of 2022, when the Fed set it at 1.22%. That was just over two years ago. Inflation has abated to a degree, but consumer prices have not abated. During this same time, wages have risen in response to inflation. What’s the effect of rising wages? Do companies just pay their employees more and not pass the cost on to the consumer? Companies operate on profit margin, not altruism. This is simple economics.

In his statement at the end of November of 2022 the current Federal Reserve Chair, Jerome Powell, stated:

“It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.”7

Is the job done? Is this why economists state interest rates are “sky high” and demand immediate Federal Reserve policy reversal? Jerome Powell warned “prematurely loosening policy” has a negative historical precedence. Politics and economic policy do not mix well. That may be what brought us to this point.

If the U.S. economy cannot sustain a moderate Fed Fund rate of 5.33% for a period, there is a much larger economic issue in the USA. The unprecedented Fed Fund rate of 0% may have seemed like an innovative idea in late 2008, but returning to that policy will leave the U.S. economy adrift in an inflationary ocean where the only direction is down.

- Alexis Sterling, “Is Jerome Powell’s Federal Reserve Playing Politics?”, Nation of Change, August 2, 2024, https://www.nationofchange.org/2024/08/02/is-jerome-powells-federal-reserve-playing-politics/. ↩︎

- Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FEDFUNDS, August 5, 2024. ↩︎

- Anna-Louise Jackson, “Quantitative Easing Explained,” Forbes Advisor, February 13, 2024, 7:33 AM, https://www.forbes.com/advisor/investing/quantitative-easing-qe/. ↩︎

- Ronald K, “Interest Rates: The Good, The Bad, and The Reality,” Lasting Logic (blog), January 9, 2024,

https://lastinglogic.com/interest-rates-the-good-the-bad-and-the-reality/ ↩︎ - Ronald K, “Interest Rates: The Good, The Bad, and The Reality,” Lasting Logic (blog), January 9, 2024,

https://lastinglogic.com/interest-rates-the-good-the-bad-and-the-reality/ ↩︎ - Ronald K, “A Federal Reserve Bank President Worth Remembering,” Lasting Logic (blog), January 9, 2024,

https://lastinglogic.com/federal-reserve-bank-president/ ↩︎ - Jerome Powell, “Inflation and the Labor Market,” speech, November 30, 2022, Federal Reserve, https://www.federalreserve.gov/newsevents/speech/powell20221130a.htm. ↩︎