Bad Economic Policy + Bad Economic Policy = Economic Disaster

How do you make a bad problem worse? Do more of whatever created the problem. Vice President Harris’ plan to give $25,000 “down payment support,” in addition to a $10,000 tax credit, to first time home buyers1 will exacerbate inflated housing prices. The cheap and free money era of the virtual 0% Federal Funds Effective Rate from 2008 through 2015 created the problem.

By early 2013, the U.S. housing market consisted of too much money chasing too few homes. That trend continued. In 2024, economists and politicians are looking for a fix that has the convenience of a fast-food drive-through order. So far, the fixes are a repackaged version of the same money handout policy. It’s just a different hand at the fast-food drive-through window.

The History that Created Chaos

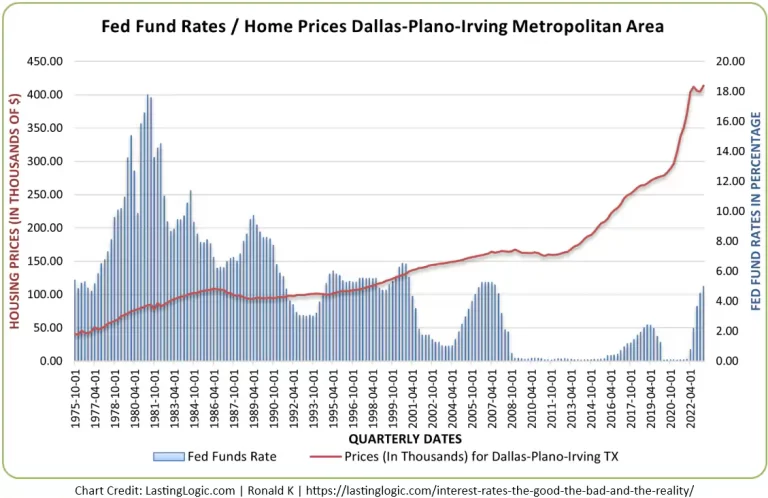

Check out the following graph.2 You will also find it in my previous post from January of 2024, “Interest Rates: The Good, The Bad, and The Reality.”3 The red line is the price of housing. The blue bars are the Federal Funds Effective Rates which affect the interest rate lending institutions charge for loans. Look closely at April of 2013 when housing valuations rocketed, and the Fed Fund Rate remained at the virtual 0%. That’s what unabated inflation looks like. That’s when the Fed failed in its primary mission to control inflation.

And: Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FEDFUNDS, November 24, 2023.

Can You Give Me the Same Problem in a Different Package?

The irony is many of those who brand VP Harris’ plan as inflationary are also pressuring the Federal Reserve Chair, Jerome Powell, to lower the Fed Fund Rate which in turn affects interest rates. Here’s the scoop: It doesn’t matter if the money comes from the federal government as “support” and a “credit,” or if it comes from federal government policy that promotes cheap, readily available cash, the result is the same. Housing prices go up and inflation is the new normal.

VP Harris’ idea of throwing more cheap and free money at this problem has one benefit. It illuminated even the most fervent, zealous cheap money supporters to the fact that throwing money at a fiscal problem causes market inflation. It’s too bad these same cheap money zealots didn’t understand the concept when eight years of artificially low interest rates caused rocketing housing valuations. Some still refuse to accept that reality.

The Magical Million Dollar Home

How do you magically turn a $500,000 dollar home into a million-dollar home? Wait ten years. The number of million-dollar homes in the USA has hit an all-time high.4 With home valuations increasing 150% in ten years, it’s easy to understand why there are many more “million dollar homes.” The magic is in the inflation. The magicians are monetary policy makers and politicians whose job was to ensure that would not happen. Now that they’ve pulled the inflationary bunny out of the hat, they can’t stuff it back in again.

This is not a positive trend even if big figures make people feel wealthy. In the January 2024 post, “Interest Rates: The Good, The Bad, and The Reality,” I quipped about even a modest home costing a million bucks in the future. That future is close to present day reality in many real estate markets and is coming to every real estate market soon.

The US economy is on the brink of an irreversible course toward not only unaffordable housing, but unaffordable housing costs such as insurance, property taxes, maintenance, and utilities. Homeowners should buckle up and figure out how much their insurance, taxes, and maintenance will be when their modest home valuation is a million dollars. I recommend a shot of Don Julio Reposado Tequila before doing so.

More Is Not Better

The typical buyer’s response to inflated costs is to ask for more money to pay the inflated costs. Banks aren’t that pliable, but policy makers appear to be. That’s what VP Harris’ housing fix is offering. Housing prices are out of control so throw money at buyers to pay the inflated costs. More money in the housing market leads to more inflated prices which necessitates even more money. The cycle continues. What will you do with the next generation of home buyers who can’t afford exponentially higher prices? More money?

We Were Warned

Read my previous articles on this subject for additional details. This includes an article I penned in 2013, “A Federal Reserve Bank President Worth Remembering,” which highlighted a previous Federal Reserve President, Esther L. George, who foresaw this potential problem.5 In January of 2013, President George stated:

“But, while I agree with keeping rates low to support the economic recovery, I also know that keeping interest rates near zero has its own set of consequences. Specifically, a prolonged period of zero interest rates may substantially increase the risks of future financial imbalances and hamper attainment of the FOMC’s 2 percent inflation goal in the future.”6

The “future financial imbalances” President George referenced are now our present “financial imbalances.” That is the effect of “a prolonged period of zero interest rates.” The FOMC is currently struggling to attain the 2 percent inflation goal. That struggle has been with us since 2013. Creative bookkeeping and manipulating statistics do not lower inflation.

Conclusion

The reality no one wants to admit is that we are at bubble housing valuations. The price of housing is up at least 150% in ten years.7 Interest rate is the price of money. That price of money is up 5.33% in sixteen years.8 Each year your home insurance cost and property taxes are based on your rising home valuation, not on the interest rate of the loan. This is economic fact, not political fiction.

So, throw more money at a problem that too much money created. Correcting inflated housing valuations by showering it with money is like trying to put out a fire by spraying gasoline on it. If the Fed decides to back off the Fed Fund Rate, unabated inflation of all consumer goods will accompany inflated housing prices whether VP Harris’ plan becomes reality or not. That inflation also applies to building material and labor costs which increase the price of new homes.

We are at an inflection point in economic history. We have a new set of players in the economic fray armed with the same 2008-2015 mindset and policies. Will doing the same thing undo the damage those policies and mindset created? Will adding another bad policy to the one that already exists do anything but create disaster? I’m laughing in disbelief as I think about it.

- Maruf, Ramishah, Wallace, Alicia, Delouya, Samantha, & Lopez, Luciana. “Harris has a plan to fix one of America’s biggest economic problems. Here’s what it means for you.” CNN Business. August 16, 2024. https://www.cnn.com/2024/08/16/business/harris-housing-plan/index.html. ↩︎

- Graph Data Taken from Quarterly Numbers Derived from Excel Spreadsheet downloaded from:

U.S. Federal Housing Finance Agency,

All-Transactions House Price Index for Dallas-Plano-Irving, TX (MSAD) [ATNHPIUS19124Q], retrieved from FRED, Federal Reserve Bank of St. Louis;

https://fred.stlouisfed.org/series/ATNHPIUS19124Q November 24, 2023.

And:

Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis;

https://fred.stlouisfed.org/series/FEDFUNDS November 24, 2023 ↩︎ - K, Ronald, “Interest Rates: The Good, The Bad, and The Reality,” Lasting Logic (blog), January 9, 2024,

https://lastinglogic.com/interest-rates-the-good-the-bad-and-the-reality/ ↩︎ - Botros, Alena. “Almost 1 in 10 homes are worth $1 million or more.” Fortune. August 16, 2024. https://fortune.com/2024/08/16/more-million-dollar-homes-than-ever/. ↩︎

- K, Ronald. “A Federal Reserve Bank President Worth Remembering.” LastingLogic. January 9, 2024. https://lastinglogic.com/federal-reserve-bank-president/. ↩︎

- Esther L. George, Fed Watch: Safe Assets and the Coordination of Fiscal and Monetary Policy, Tim Duy’s Fed Watch, January 12, 2013, https://economistsview.typepad.com/timduy/2013/01/safe-assets-and-the-coordination-of-fiscal-and-monetary-policy.html. ↩︎

- Ronald K, “Interest Rates: The Good, The Bad, and The Reality,” ↩︎

- K, Ronald. “The Federal Reserve and the Price of Political Policy.” LastingLogic. August 5, 2024. https://lastinglogic.com/the-federal-reserve-and-the-price-of-political-policy/. ↩︎