A Federal Reserve Bank President Worth Remembering

I posted this one on March 24, 2013. This post highlights a savvy Fed President, Esther L. George, whose logic on inflation appeared to be spot on considering our inflation rate for 2023-2024. Her logic is an example of true “Lasting Logic” that withstood the test of time.

Ronald K

March 24, 2013

The Brave New Economy

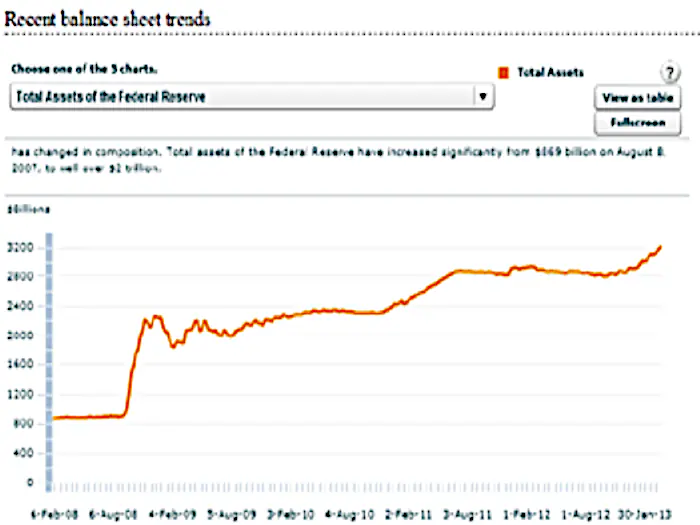

The Federal Reserve System, under the direction of the current chairman, Ben Bernanke, has steered the American economy farther into uncharted economic waters during the recent meeting of the Federal Open Market Committee (FOMC). The bond and mortgage-backed securities asset acquisition is without precedent. Is Chairman Bernanke like Christopher Columbus taking us to a brave new economic world, or is he the captain of the economic Titanic letting us drink champagne from the fountain of our newfound stock market wealth until we hit a fatal economic iceberg? Let’s level-set by looking at the Federal Reserve’s chart on asset acquisitions.

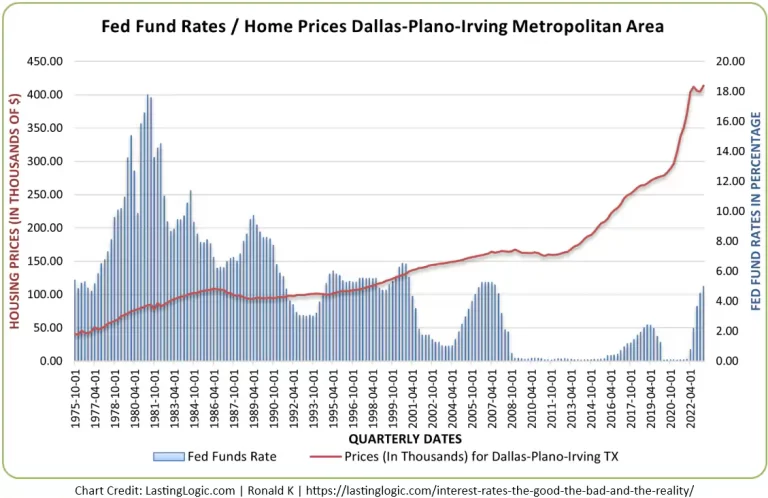

Doing the math, on September 3rd, 2008, the value of assets purchased was $907 billion. On March 13th, 2013, it was $3.16 trillion, which is roughly a 250% increase. Is this unprecedented, open-ended buying binge an issue? Esther L. George, President and Chief Executive Officer of the Federal Reserve Bank of Kansas City, has provided insight on the matter. On January 10th, 2013, President George stated, “To be clear, I agree that the depth of the last recession warranted a highly accommodative monetary policy response. Further, a recovery marked by high unemployment and low inflation may well warrant low rates for a longer period than usual. But, while I agree with keeping rates low to support the economic recovery, I also know that keeping interest rates near zero has its own set of consequences. Specifically, a prolonged period of zero interest rates may substantially increase the risks of future financial imbalances and hamper attainment of the FOMC’s 2 percent inflation goal in the future.”

While inflation may be the factor of greatest concern, the “future financial imbalances” are of greater consequence. The economic model is changing. President George states, “A long period of unusually low interest rates is changing investors’ behavior and is reshaping the products and the asset mix of financial institutions. Investors of all profiles are driven to reach for yield, which can create financial distortions if risk is masked or imperfectly measured, and can encourage risks to concentrate in unexpected corners of the economy and financial system. Companies and financial institutions, such as insurance companies and pension funds, and individual savers who traditionally invest in long-term safe assets, are facing challenges earning reasonable returns, and so they may reach for yield by taking on more risk and reallocating resources to earn higher returns. The push toward increased risk-taking is the intention of such policy, but the longer-term consequences are not well understood.”

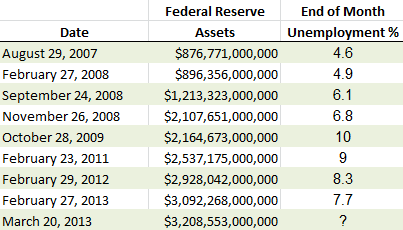

So, what kind of bang are we getting for our Federal Reserve buck? The spreadsheet to your right is a quick glance at the results. On February 27, 2008, the Federal Reserve’s balance sheet was at $896.3 billion, and unemployment was 4.9%. On March 20, 2013, the Fed’s balance was $3.2 trillion, and the unemployment was 7.7%. The 7.7% unemployment does not include those who may have given up looking for work.

On March 22, 2013, at the National Community Reinvestment Coalition Annual Conference, Washington, D.C., a Federal Reserve Governor, Sarah Bloom Raskin stated, “About two-thirds of all job losses resulting from the recession were in moderate-wage occupations, such as manufacturing, skilled construction, and office administration jobs. However, these occupations have accounted for less than one-quarter of subsequent job gains. The declines in lower-wage occupations–such as retail sales and food service–accounted for about one-fifth of job loss, but a bit more than one-half of subsequent job gains. Indeed, recent job gains have been largely concentrated in lower-wage occupations such as retail sales, food preparation, manual labor, home health care, and customer service.”

There are notable economists such as Paul Krugman who state we should look to debt laden Japan as an economic model for our future. Is that where Chairman Bernanke is taking us? To Japan? The European economy is beginning to look better all the time. If Chairman Bernanke is like Columbus, he may want to remember that Columbus didn’t jump ship before reaching his destination. Chairman Bernanke is already making exit plans for 2014. I know who I’d want to move into the Chair and Vice Chair of the Board of Governors of the Federal Reserve. President George and Governor Raskin, are you available?

It should be noted that Federal Reserve President George is not eligible for appointment to the Chair or Vice Chair position of the Federal Reserve System Board of Governors, as she currently does not hold a position as a Federal Reserve System Governor. At this time, she is a voting member of the FOMC and cast the only dissenting vote at the March 20, 2013, meeting citing she was “concerned that the continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations.”

The evidence suggests that they knew this system of global finance would eventually crash and need to be absorbed into a new financial system, much like when the USA took over and absorbed England’s global system. Here it seems like our system has failed and they are trying to create a path to absorb our failed system into a new digital system perhaps that our corrupt deep state can continue to control. If not, we’re all going to be Communist China in a few years. Unfortunately, I hold out little hope for a smooth transition to what comes next.