Interest Rates: The Good, The Bad, and The Reality

The Short Story Version

Before we start, let’s introduce two terms low interest rate advocates do not use. Free Money and Cheap Money. Free Money is the money you borrow at no cost. It’s rare but getting as close as possible to 0.0% interest rates is good as it gets. That brings us to cheap money. Cheap Money is money borrowed near the 0.0% interest rate. Now, if you can get free or cheap money in quantity you can buy a house, a car, or invest in stock buybacks if you’re a large corporation. Buying a house sounds like a great idea. Let’s do it! Hold on for a second. What do you mean I’m not the only one with the great idea of buying a house with my newfound cheap money? Okay, now I’m competing with anyone who can qualify for a cheap money loan. Subprime, anyone? I don’t care. I’m a cheap-money high roller. I can handle the competition. The fact that the house I want to buy cost over 5% more than 1 year ago,1 40 to 45% more than 3 years ago, and almost 150% more than 10 years ago2 doesn’t faze me. All I have to do is show up, wave my cheap money magic wand in front of the real estate agent, the person selling the house will swoon with euphoria, and voilà, I have my dream home. So, I go to my real estate agent, explain my detailed plan, and he tells me, “Get ready for a bidding war.” You’re kidding, right? I am a high-rolling, cheap-money, Daddy Warbucks. He says, “You and everyone else.” I go back to the bank loan place, tell them what the reality of the housing market is, because they are obviously unaware, and ask for more cash. They laugh and say something absurd like, “We already know what the housing market is like.” Then they get snarky and tell me, “That’s all you qualify for, so find something that’s in your budget.” I tell them about my potential earning power since I’m a high roller. They remind me it’s their money I’m rolling high on. I walk out thinking, “If only housing prices were more reasonable, I wouldn’t have to deal with snarky people like that.” On top of all those problems, they want a 20% down payment from me. They think they can get away with a fast one, but I’ve already done the math. 20% of $400,000 is $10,000 more than 20% of $350,000.

So, I get into multiple bidding wars. Still no dream home. My expectations lower. Maybe not a dream home but whatever I can afford. Inflation is so bad my rent is killing me, and I have nothing to show for it. Finally, success. I’ve outbid the rest of those cheap-money freeloaders. A month later I find out the increased price on the house cost me $125 more per month in property taxes, and $35 a month more in insurance. The worst part is the house maintenance cost on this old thing is unsustainable, and it’s far removed from that dream home expectation I had when the experts told me, “Low interest rates are all you need to own your dream home.”

How it Happened

The above is the short story version of the free-money and cheap-money reality. So, why does a house cost almost 150% more than 10 years ago? Did it age like fine wine therefore it’s worth so much more now? No. It did that because in 2008 the Central Bank decided to make free-money and cheap-money a preferred tool to deal with an imploded economy, and they did it for eight consecutive years. At the virtual 0% interest rate, or around or below 0.25% Fed Fund rate as they like to refer to it, life was good. Not only that, but they also had one Quantitative Easing after another, too-big-to-fail bank bailouts, and government handouts to corporations who pledged to be more responsible in the future. The Fed was producing money faster than the economy could produce houses, autos—and almost all other consumer goods. Yes, the old “supply and demand” thing. A lot of money in the economy chasing fewer houses on the market. If you were part of the Venture Capital corporate elite, you could wield greater clout and get closer to the free money side of things. For the VC groups, it was party time. Other than throw it at the stock market and create near frothy values, they could buy houses en masse and rent them to people who can’t afford to buy a single home.

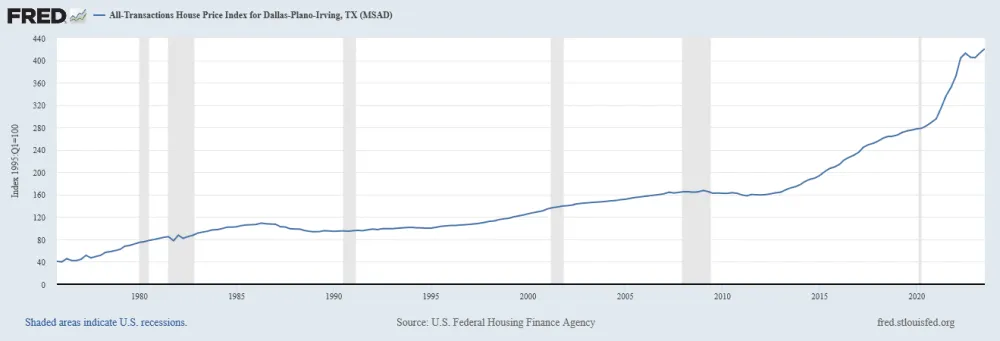

Here’s what it looks like for a major metropolitan area in Texas:

So, not only did housing prices increase, but everything else did too. They kept it a secret as long as possible, but you can’t keep a good Central Bank down. While the current interest rate doves want us to think the rising interest rates were determined via the PIDOOMA methodology (Pulled It Directly Out Of My A…), the Fed realized the error of their misguided ways in December of 2015. At that point, they started raising rates until it hit a high of 2.40% in July of 2019. Then the unforeseen took over: Covid-19. The rates went into a gradual decline as the economy suffered through a literal economic shutdown. In March of 2022, when Covid no longer could be factored into the equation, the inevitable reality of an overheated economy couldn’t be denied. Trying to convince us inflation was “transitory” and “temporary” didn’t work so the Fed started raising rates again. The Fed had realized it couldn’t reason with the undisciplined inflationary child which was born in 2008.

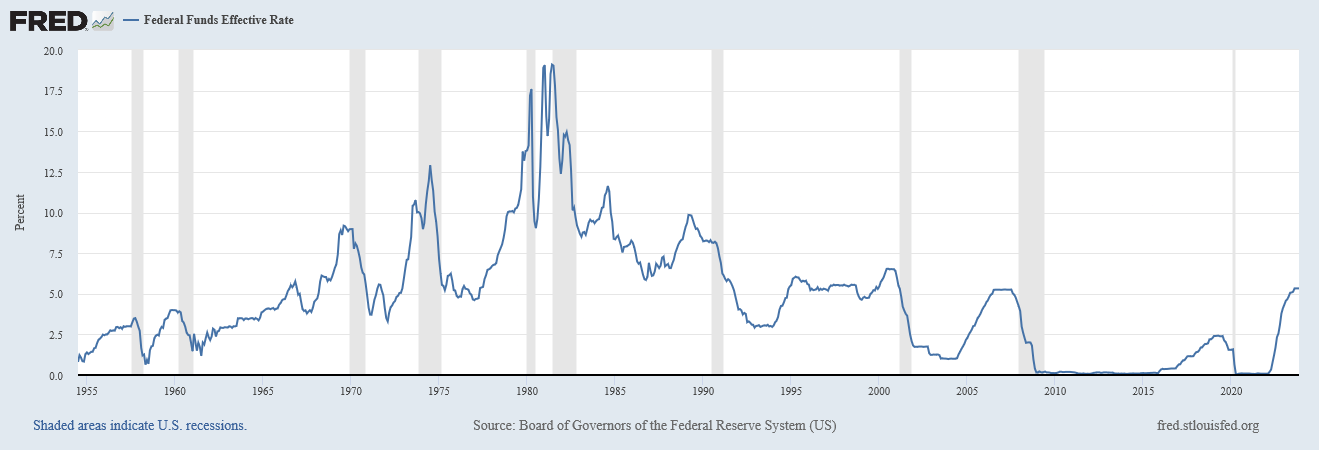

Let’s put the Fed Fund Effective Rates, which influence interest rates, in perspective with a handy chart:3

| Time Period | Minimum Federal Funds Effective Rate for the Time Period. | Maximum Federal Funds Effective Rate for the Time Period |

| July 1, 1954 – Nov 1, 2008 | .39% | 19.10% |

| Dec 1, 2008 – Nov 1, 2016 | 0.07% | 0.41% |

| Dec 1, 2016 – Oct 1, 2023 | 0.05% | 5.33% |

So, for the 54-year 4-month span between 1954 to 2008, the MINIMUM interest rate was only 0.02% lower than the MAXIMUM interest rate between late 2008 and late 2016, a 7-year 11-month period. That 7-year 11-month span of free and cheap money took the economy into uncharted financial waters. Also, the all-time high rate since 1954 is 19.10%, which is 13.77% more than the October 2023 rate. So, the “We’re at an all-time high interest rate” argument is, well, overrated.

Now, a “Federal Funds Effective Rate” graph for the visually oriented:

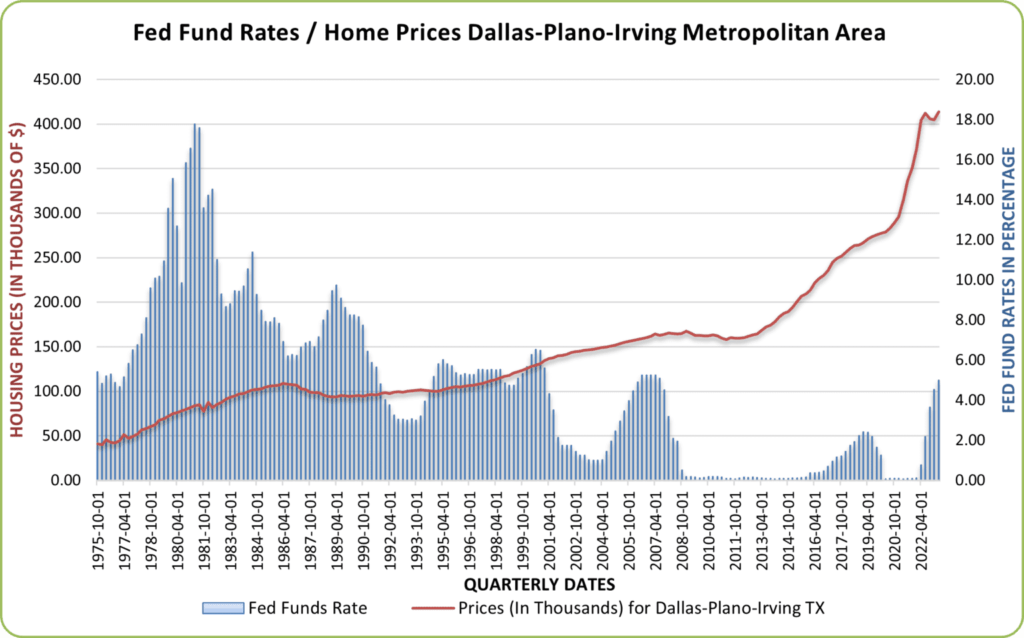

One more graph plotting the Federal Funds Effective Rate to the housing prices for the Dallas-Plano-Irving Texas metropolitan area.4 This graph plots the housing and Federal Funds Effective Rates data together beginning in 1975 into 2023.

And: Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FEDFUNDS, November 24, 2023.

Check out the period just before the April 1, 2013, as the housing prices escalated, and the Federal Funds Effective Rate remained flat. Prior to that time, housing prices gradually rose since 1975, even during the “financial crisis” in the 2007-2012 span. The last time housing went up almost 150% was between 1975 to approximately 2005, a 30-YEAR PERIOD. Also, during that 30-year period, it was a difference of about $100,000. Between 2013 and 2023, a 10-YEAR PERIOD, the 150% increase is around $236,000. Which seems more reasonable, a $100,000 increase over 30-years or a $236,000 increase over 10-years? I’ll let you handle the math.

Let’s recap here:

- From 2008 to 2016, The Fed was producing money faster than the product, housing, was becoming available.

- The onset of inflation crept into the economy, but no one wanted to talk about it. Translation: The building material cost to construct new houses was going up along with the cost of everything else.

- People didn’t want to sell their homes because prices were going up so fast, they couldn’t afford to buy another one after the sale of their current home. Ask a real estate agent about the shortage of houses on the market. It was, and still is, their major complaint/excuse for not having “inventory.” This led to less housing supply and cheap money kept incrementing the demand as more buyers entered the already overcrowded housing market.

- If you were in the corporate class, you’d get closer to free money when Fed Fund Rates are below 0.25%. They could buy houses in bulk and rent them out to people who can’t afford to buy a single house.

Free and cheap money is the fentanyl of the working class and the corporate elite. Once you get a taste of the stuff, you’re ready to tie off and mainline it any time you can get it. Yeah, it feels that good. But what if your dealer tells you, “Your next money fix is going to cost you more.” You say, “Why?” They say, “Inflation.” You say, “I know inflation is bad, that’s why I need the money.” They say, “Think of it as the inflated price of money.” That’s it. A showstopper.

The Federal Reserve’s Response to Inflation

Adjusting interest rates is the primary tool in the Central Bank’s tool belt. It’s not a new thing. That has been the standard for decades. Why the Fed delayed interest rate hikes in the 2009-2016 period is a good question. By February of 2013, a little over 10 years ago, the S&P 500 was back to its previous all-time high, and housing prices were back to their pre-economic collapse levels. At that point, the stock market, housing prices, and inflation were rising fast. That should have signaled the Fed to adjust rates, but no one wanted to think or talk about it. People were already hooked on free and cheap money, and getting between an addict and their preferred drug is a dangerous position to be in. The reason the Fed is raising rates now is—Inflation. Even the people addicted to free and cheap money criticized the Fed’s inability to control it. They just don’t realize they are forcing their dealer to choose between cutting off their free and cheap money drug supply or stopping inflation. How does the Fed say this on their website?

“As the Federal Reserve conducts monetary policy, it influences employment and inflation primarily through using its policy tools to influence the availability and cost of credit in the economy.

The primary tool the Federal Reserve uses to conduct monetary policy is the federal funds rate—the rate that banks pay for overnight borrowing in the federal funds market. Changes in the federal funds rate influence other interest rates that in turn influence borrowing costs for households and businesses as well as broader financial conditions.”5

So, when someone is complaining about having to pay an extra 3 to 5% in interest, why weren’t they complaining when housing prices increased over 5% in 1 year, 40 to 45% in 3 years, and almost 150% in 10 years? Those housing cost increases came courtesy of low interest rates. So, do you really want to back off interest rates again? Why not? What’s so bad about buying a 20-year-old 3-bedroom, 1500 square foot house on 0.15 acre for a million bucks? You can brag about the 2.9% interest rate you snagged to buy the place. Oh, and you pay the 2.9% on the increased cost also, but it’s only 2.9% and a $200,000 down payment. What a deal!

- Federal Housing Finance Agency. “FHFA House Price Index Up 0.6 Percent in August; Up 5.6 Percent from Last Year” October 31, 2023. Accessed: November 20, 2023.

https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-HPI-Up-0pt6-Percent-in-August-Up-5pt6-Percent-from-Last-Year.aspx ↩︎ - Figures from Dallas-Plano-Irving TX area. Data provided by:

U.S. Federal Housing Finance Agency, All-Transactions House Price Index for Dallas-Plano-Irving, TX (MSAD) [ATNHPIUS19124Q], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ATNHPIUS19124Q

November 18, 2023. ↩︎ - Amounts provided in Excel spreadsheet download from:

Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis;

https://fred.stlouisfed.org/series/FEDFUNDS

November 20, 2023 ↩︎ - Graph Data Taken from Quarterly Numbers Derived from Excel Spreadsheet downloaded from:

U.S. Federal Housing Finance Agency,

All-Transactions House Price Index for Dallas-Plano-Irving, TX (MSAD) [ATNHPIUS19124Q], retrieved from FRED, Federal Reserve Bank of St. Louis;

https://fred.stlouisfed.org/series/ATNHPIUS19124Q November 24, 2023.

And:

Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis;

https://fred.stlouisfed.org/series/FEDFUNDS November 24, 2023. ↩︎ - Board of Governors of the Federal Reserve System. “How does the Federal Reserve affect inflation and employment?” Last Update: August 27, 2020. Accessed: November 20, 2023.

https://www.federalreserve.gov/faqs/money_12856.htm ↩︎

“I am a high-rolling, cheap-money, Daddy Warbucks.”

#metoo, baby.

Great read! Logical, even!

Great article! Suggested title: “How the greedy have trapped us all in an escalating cycle of stupid!” Maybe the only way out is to evacuate to a barren wasteland where you can buy it all for a $1.00 and pray they don’t discover something valuable underneath you that they will kill you to take it from you.